Mazars evaluates US Current Expected Credit Losses (CECL) models through the covid-19 crisis

IndustriesFinancial servicesBanking & capital marketsBanking & Capital Markets Insights

CECL models review through the covid-19 crisis

The Financial Accounting Standards Board’s new CECL accounting standard went into effect on 1 January 2020 for institutions that were public business entities and SEC filers excluding smaller reporting companies (SRCs). At the onset of the covid-19 pandemic, the government introduced several regulatory rules that aimed at providing relief to organisations both from a financial reporting perspective and a regulatory capital perspective.

Mazars conducted a review of 12 banks that implemented the CECL standard. The analysis is based on interim financial statements as of 30 June 2020, focusing on the following areas:

Quantitative assessment:

- Opening balance impact of CECL adoption

- Trends of ACL (Allowance for Credit Loss) as a percentage of gross loans

- Impact on operating profit due to CECL implementation

- Accumulation of credit reserve build due to volatility and foreseeable instability

- Evaluation of non-performing loans due to delinquencies

Qualitative assessment:

- Governance and oversight

- CECL implementation methodology

- Data quality including macroeconomic variables used

- Reasonable & supportable forecast period

- Reversion method

- Other accounting treatment interpretations

- Regulatory considerations

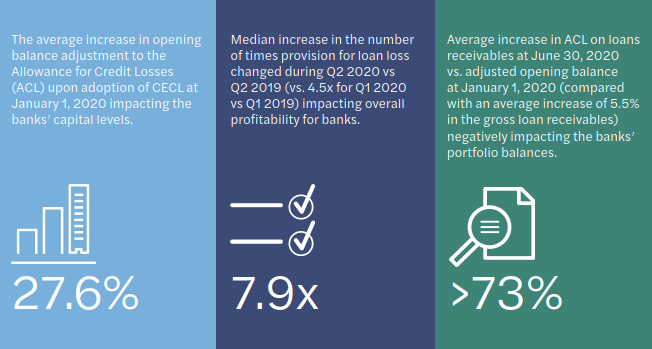

Top findings: