Guide to Raising Capital for your Business

Guide to Raising Capital for your Business

Guide to Raising Capital for your Business

There are many reasons why companies of all sizes look for capital. From start-ups to established companies and from online to “brick and mortar” companies. But the common factor of raising capital is to allow the business to achieve their goals.

For this very reason, more than half of companies indicate their businesses fail mainly due to the lack of capital.

So, the main question is how should they go about financing their business?

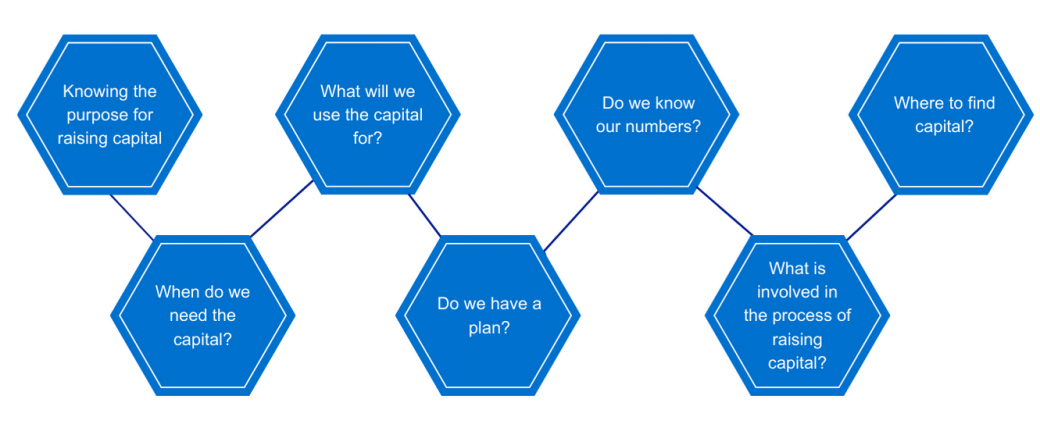

Below is a quick non-exhaustive guide to raising capital for your business:

1. Knowing the purpose for raising capital

The purpose of raising capital could be specific in nature or it may be time-bound.

Specific in nature

For example, the development and launch of a new product or service offering could require capital that a company does not have. As such, it can either wait until it has enough money to develop and launch the product or to seek external funding to develop and launch it as soon as possible.

Time-Bound

In other cases, there may be an urgency to undertake a business initiative in order not to miss an opportunity and as such, will need capital to kick-start this project.

2. When do we need the capital?

Raising capital is not a one-day event; it would typically take a few months.

From defining your business plan, to developing a strategy to approach potentially interested parties, to meetings with such potential investors, to securing the deal and to obtaining the capital, it can easily take between 6 to 9 months.

Therefore, it is important to understand the timeline of when capital is required and plan the steps beforehand.

3. What will we use the capital for?

Raising capital may be required for various reasons, including a business idea.

For a business idea, when a company has not been established, capital may be required to develop and launch its first product or even to set up their own office space and employ staff. It is the same process for all stages when discussing about raising capital.

A more established company may raise capital to develop and launch a new product which may require cash up front, such as research and development, marketing, etc. All these steps may incur costs and therefore, will also require additional capital.

4. Do we have a plan?

The plan or the “pitch” is important when obtaining funding. One of the most successful Venture Capital (“VC”) firms mentioned that the plan needs to convey the main reasons why an investor should love your business in the first 5 minutes.

This is a high-standard requirement but generally do keep your pitch concise where you can present it within a 20-minute time frame.

The pitch has to cover 3 main factors:

Explain what has changed

Present the market’s problem statements currently being faced or areas which the current market offering is lacking.

Explain what you do

In one sentence, show how your company can take advantage of such an opportunity or opportunities.

Explain the facts

Get to your company’s overview and financials fast. Present the opportunity with figures like the milestones to be achieved and discuss who your team are and their capabilities and credentials.

5. Do we know our numbers?

Proper budgeting and planning are required. Even if deadlines appear far into the future, companies need to avoid a situation where it would require the business to have regular capital injections of cash in order to survive.

Ultimately, being profit making and self-sustainable are the fundamental key driver to be a successful business, which would mean that once you are successful in raising capital for your company, it should be able to survive on its own.

6. What is involved in the process of raising capital?

One of the main components of the process of raising capital is to have a plan to present to potential investors.

The plan needs to showcase the value of your company and “what is on the table” such as highlighting what is the deal inclusive or exclusive of. For example, in order to raise capital, would this be a debt (i.e. loan) or an equity transaction (i.e. selling shares in exchange for funds) or a combination of both?

Whilst having a plan is important, it is also equally important to know what kind of investors are we looking for?

Once a suitable party is identified, when discussing the details of the deal, it is also important to be open to negotiations, exchange opinions, verify numbers, etc. and to have an open mind.

At the end of the day, it comes down to a willing-buyer-willing-seller situation so it is important to debate and find a value for the company that would appear achievable and justifiable to both the company and the investor.

7. Where to find capital?

There are many options available to find capital. It ranges from using your own funds, borrowing from friends and family, seeking out angel investors or using venture-capital firms.

It is important not to get discouraged if one does not work out. As long we demonstrate that you know what you are doing and what you are worth, you will be able to raise the capital that you need.

Our experts