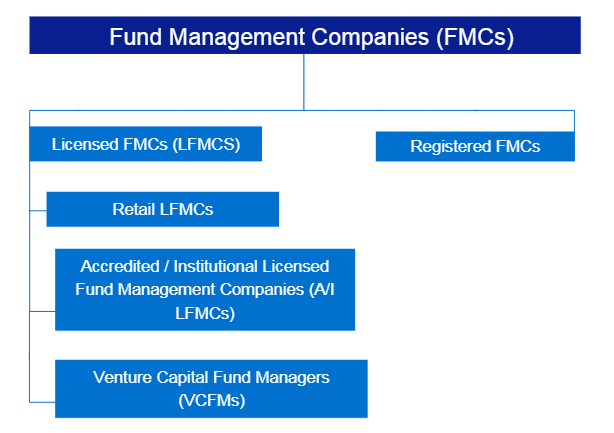

Regulatory Compliance for Fund Management Companies

This includes Registered Fund Management Company (“RFMC”), Capital Markets Services License (“CMSL”) as a Licensed Fund Management Company or a Venture Capital Fund Manager (“VCFM”) or be expressly exempted from holding a Licence.

An Ongoing Challenge of Compliance

With increasing economic pressure comes greater need for compliance and management in the Financial Services sector. The result is tighter control and a larger appetite for transparency – globally and domestically. Many FMCs have had to bear higher compliance costs while managing the need for compliance knowledge resources. Keeping abreast with the dynamic compliance landscape can prove to be a challenging task.

The issue of ongoing regulatory compliance is steadily growing in Singapore. As a global financial hub experiencing increasing volumes of transactions, regulators continue to drive vigilance against money laundering and terrorist financing activities. It is important for FMCs to remain compliant with the current standards, guidelines and regulations. Any breach in compliance may result in regulatory fines, adverse reputation risk, growth, and sustainability of these institutions and the industry as a whole.

In this year alone, MAS has imposed hefty penalties for those who failed to comply with Anti-Money Laundering (“AML”) / Combating the Financing of Terrorism (“CFT”) requirements. For not disclosing shareholding interests, an investor was fined $200,000.1 In another incident, a FI received a $400,000 penalty for not exercising sufficient oversight in ensuring effective AML/CFT controls.2 Ultimately, this oversight placed the institution as a high-risk target for Money Laundering and Terrorist Financing activities.

These lapses do not only lead to mulcts. Reputational risks such as loss in investor confidence will also occur and those will be harder to recover from. Such occurrences are preventable and easily mitigated. By building a risk-aware culture, a responsive 1st and 2nd line of defence which are control-compliant, FMCs can continue and grow their status as part of a premier financial centre.

Mazars can assist you in fulfilling all your regulatory compliance requirements. Our dedicated regulatory compliance team comes with extensive knowledge, diverse experience and ability to react swiftly. This enables us to support you in achieving your regulatory requirements without any disruption to your business.

In addition, being an international, integrated, and independent partnership, Mazars can also provide you cross-border compliance assistance thanks to our global network and expertise located in more than 91 countries.

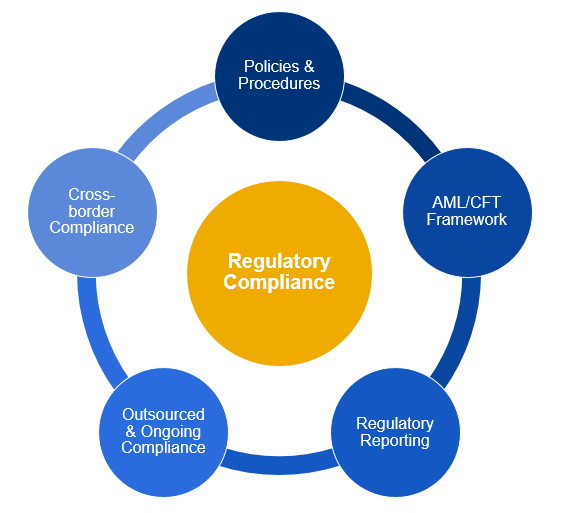

Mazars Regulatory Compliance Framework

How Mazars Can Help With Your Compliance Initiatives

We draw upon our extensive experience to help organisations develop and formulate a robust and sustainable compliance management initiative. Essentially, we help organisations stay ahead of the curve by identifying tell-tale signs of potential problems, or by pre-empting threats to the organisation. The earlier the response, the easier these risks are to mitigate.

1. Policies and procedures

Compliance policy and procedure documents are the foundation of any compliance program.

Establishing and drafting these documents is a crucial step to any financial institution including FMCs. It enables the organisation to effectively set up and design the compliance framework, therefore defining the controls conducted by the compliance function and driving consistency across your processes.

Our team has the relevant expertise to develop well-designed and comprehensive policies to protect your business from increasingly rigorous legal and regulatory constraints, while reinforcing a culture of compliance and ongoing monitoring.

We can help you develop or improve policies and procedures for the following:

- Compliance Manuals: regulatory requirements, assignment of responsibilities, remuneration policy, monitoring policy, conflict of interest policy, account dealing policy, investment suitability policy, and more.

- Standard Operating Procedures ("SOP") facilitate FMCs to embed sound internal controls in daily operational tasks, which improves overall compliance environment and enhance level of scrutiny during day-to-day operation.

- Compliance monitoring plans including compliance organisation, ethics, integrity of the customer relationship and financial security.

- Operational / Business Manuals: operational procedures related to your day-to-day business conduct such as on-boarding procedure, client’s account management procedure, account closing procedure, transactions monitoring procedure, and more.

2. AML/CFT Framework

A reputation for integrity is one of the most valuable assets of a financial organisation.

The integrity of the fund management company depends primarily on the perception that it functions within a framework of high legal, professional and ethical standards. If funds from criminal activities can be easily processed through a particular institution, this will affect its reputation and in some cases, result in prosecution and the loss of licence to undertake financial business. Our goal is to assist you in building and improving an efficient financial security framework while preserving your reputation for integrity.

Our dedicated team can help you develop or improve your AML/CFT framework:

- AML/CFT policies and procedures: AML risk assessment methodology, customer due diligence procedure, on-going monitoring of the business relationship, asset freezing and sanctions policy, and more.

- AML and sanctions monitoring tools: AML risk assessment tool, transactions monitoring, sanctions and blacklists screening. In addition, we bring you data analytics solutions, deep industry expertise and significant experience in successfully assisting our clients to run and implement regulatory transformation projects.

- Training: our experts can design a tailor-made AML training highlighting your relevant red flags.

3. Regulatory Reporting

Mazars can assist you in the ongoing review of the quarterly forms (Form 1 and Form 2) to ensure that the basis of preparation and computation is consistent with the relevant MAS Notice.

4. Outsourced and Ongoing Compliance

FMCs shall establish monitoring and ongoing surveillance processes that allow them to identify, analyse and mitigate potential compliance breaches.

Mazars helps its clients to objectively analyse whether they are meeting specified guidelines, industry requirements and regulations to mitigate ongoing risk. Our dedicated regulatory compliance team can assist you in the following:

- Outsourced compliance: provide a quality and cost-effective alternative to in-house compliance for all businesses that need ongoing compliance support.

- Assistance or externalisation of Internal Audit, which comprises of:

- General health check on Financial, Operational, Compliance & IT gaps: ‘Stress-Test’ adequacy of existing internal controls design, highlight potential process risks and provide recommendations.

- Internal control framework: assess the adequacy and robustness of your existing internal control framework, aiming to improve your overall internal control environment for compliance risk mitigation; and

- Outsourced Internal Audit Function: whether you are considering outsourcing the entire internal audit function, a co‑sourcing arrangement, or require assistance to deliver ad-hoc assignments, a tailored approach will be provided by our experts.

- Risk management: assess the risks that can potentially disrupt your business, and help you take the necessary steps to address ongoing changes in the business environment and compliance needs.

- Regulatory remediation: our experts can support you in addressing and remediating compliance deficiencies following regulatory inspection, by providing a relevant action plan and ensuring its effective implementation within the indicated deadlines.

5. Cross-border Compliance

Mazars is an international, integrated and independent partnership. We can mobilise our regulatory compliance experts abroad in order to successfully assist you in any cross-border compliance issue or concern.

Do reach out to us for a complimentary high-level “Compliance Health-Screening” on your existing AML/CFT framework to provide you with insights on potential compliance gaps.

Do you have any questions?

Source:

1. Investor Fined $200,000 by MAS in First Civil Penalty for not disclosing shareholding interest, The Straits Times.

2. MAS Imposes Composition Penalty of $400,000 on TMF Trustees Singapore Limited for AML/CFT Failures, The Monetary Authority of Singapore.