Annual filings in Singapore: The ultimate guide to financial statements and XBRL

In this guide, we cover everything you need to know including the documents to prepare, the deadline and what happens if you fail to comply with the regulations. Read our guide to find out more about annual filings for Singapore companies.

Let’s start with your annual return checklist:

An annual return is a yearly statement containing important particulars of the company’s composition, activities and financial position.

The appointed officer of your company can file the annual return on ACRA’s online filing portal BizFile+. Alternatively, you can engage the services of a registered filing agent to do this for you.

Contact us for annual filing assistance

An annual return typically contains the following:

- Company details: Your company’s name, unique entity number and registered address

- Principal activities: A description of your company’s business activities

- Details of company officers: details of your company directors, secretary and board members

- Shareholder details, share capital (if applicable)

- Financial statements: Check whether your company is required to file financial statements with the annual return. Companies that are not required to file financial statements must instead submit an online declaration.

Financial statements

Your financial statement needs to have the following:

- Statement of Financial Position: This is a balance sheet reflecting your equity, assets, and liabilities.

- Statement of Comprehensive Income: This includes your revenue, expenses, gains and losses, and income tax. It reflects your company's financial performance during that period.

- Statement of Cash Flows: This shows cash or cash equivalents flowing out of or into your company as a result of its operating, investing and financing activities.

- Statement of Equity Changes: This includes transactions between your company and its shareholders, changes to its share capital at the beginning and the end of the financial year, the classes of shares issued and dividends during that year, if applicable.

- Notes of significant accounting policies.

Without going into too much technicality, your company may be required to have your financial statements audited if your company/group meets any two of the following conditions:

- Total annual revenue exceeding S$10 million;

- Total assets exceeding S$10 million; or

- Has more than 50 employees

Annual General Meeting (AGM)

Unless exempted/dispensed, an AGM is a mandatory annual meeting of shareholders to keep them updated about your company’s affairs. At the AGM, your company will present your financial statements before the shareholders. The financial statements must be considered and approved by shareholders.

Private companies may be exempted from holding AGMs if they send their financial statements to their members within five months after the financial year end.

XBRL

Since 2014, Singapore companies are required to file their financial statements in eXtensible Business Reporting Language (XBRL), except for those which are exempted. This is an XML-based format for financial documents that businesses use to exchange financial information.

Contact us for XBRL assistance

Do you need a full set of financial statement in XBRL format or in PDF format? Check out the table below:

Group | Companies that file FS that are made public | XBRL Filing Requirements |

1 | SG-incorporated companies that are not covered in Groups 2 to 5 below. | To file FS in XBRL format, and the extent of XBRL filing varies based on the company’s nature and size of operations:

All other companies - To file FS in Full XBRL template. |

2 | SG-incorporated exempt private companies (EPCs) that are insolvent | To file FS in XBRL format, and the extent of XBRL filing varies based on the company’s nature and size of operations:

All other companies - To file FS in Full XBRL template. |

3 | SG-incorporated EPCs that are solvent | Not required to file FS. If the company opts to voluntarily file, to file FS in either:

If the company opts to file FS in XBRL format, its extent of XBRL filing will vary based on the same criteria as Groups 1 and 2. |

4 | SG-incorporated companies in the business of banking, finance and insurance regulated by MAS | To file FS in:

together with PDF copy of the FS authorised by directors. |

5 | SG-incorporated companies preparing FS using accounting standards other than prescribed accounting standards in Singapore or IFRS | To file only PDF copy of the FS authorised by directors. |

6 | SG-incorporated companies limited by guarantee | To file only PDF copy of the FS authorised by directors. |

7 | Foreign companies with SG branches | To file only PDF copy of the FS authorised by directors. |

Source: ACRA

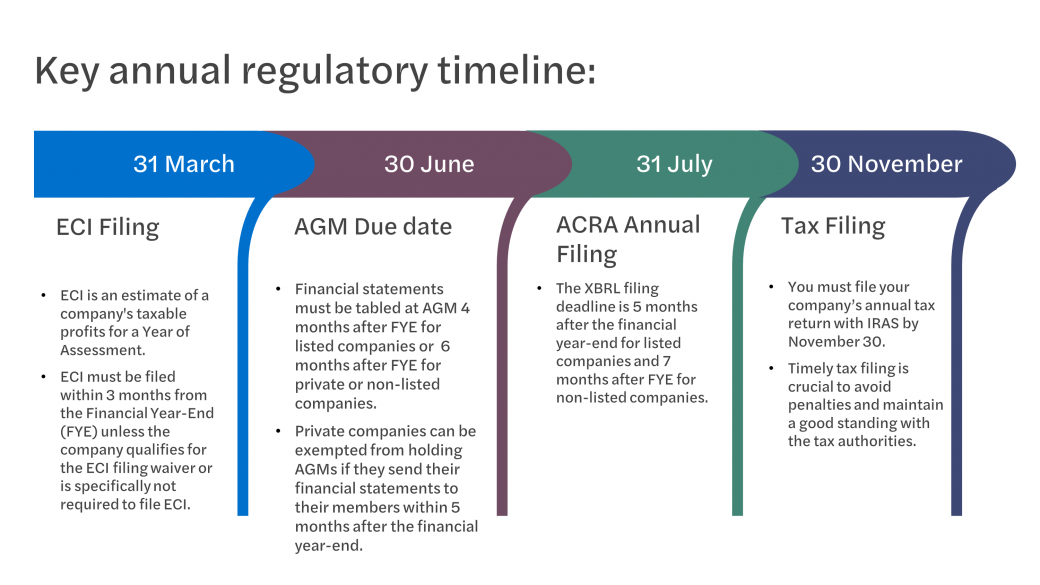

Key Timeline for Annual Filing

The Singapore Companies Act requires all companies to file an Annual Return with ACRA within 7 months from the end of their financial year-end.

Discover the important deadlines that companies with a financial year ending on 31 December must adhere to:

Penalties for late filing of annual returns

Your company must file your annual returns on time. Companies that file annual returns after the due date will be imposed with a late lodgement penalty of up to $600 for each late filing.

Ready to streamline your annual filing process?

Don’t let the complexities of filing annual returns overwhelm you. Let our experts handle your financial statement and XBRL preparation.

At Mazars, we provide quality, accuracy and timely preparation and filing of annual returns, so you can focus on your core business activities.

Contact us today to get started!